43+ can i deduct second home mortgage interest

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web These are mortgages taken out after Oct.

Admin Proc Manual Pdf Payments Email

Web You can deduct property taxes on your second home too.

. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible. In the 2021 tax year the IRS temporarily allowed individuals to deduct 300 per person those married filing jointly.

Web If your total principal amount outstanding is 750000 375000 if married filing separately or less you can deduct the full amount of interest paid on all mortgages for a main or. Web If youve closed on a mortgage on or after Jan. Homeowners who bought houses before December 16.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. In fact unlike the mortgage interest rule you can deduct property taxes paid on any number of homes. Ad A Tax Advisor Will Answer You Now.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web Most homeowners can deduct all of their mortgage interest. Web The mortgage interest deduction is a tax incentive for homeowners.

Find Your Low Fixed Rate. Web Answer Yes and maybe. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than.

Questions Answered Every 9 Seconds. 13 1987 and used for other purposes besides buying building or improving your homes. Web Unfortunately as of April 2022 the answer is no.

Generally for the first and. Ad Consider a Second Mortgage to Tap Into Your Home Equity. However higher limitations 1 million 500000 if.

The standard deduction is 19400 for those filing as head. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. This itemized deduction allows homeowners to subtract mortgage interest from their.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

If you took out your home loan before. Get a Better Mortgage Now and for the Future. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

2023 S Best Home Equity Loans Consumersadvocate Org

Pdf Income Tax And Vat Issues Concerning Leases After Ifrs 16 Convergence In Indonesia

Can I Deduct The Interest On A Second Home

Declaring A Motor Home As A Second Home On Federal Tax Returns

Deduct Mortgage Interest On Second Home

Pdf Income Tax And Vat Issues Concerning Leases After Ifrs 16 Convergence In Indonesia

Deduct Mortgage Interest On Second Home

Proceedings Tome 1 By Mgs Symposium Issuu

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Second Home Tax Deductions Tax Tips For Homeowners

Pdf Income Tax And Vat Issues Concerning Leases After Ifrs 16 Convergence In Indonesia

Second Mortgage Tax Benefits Complete Guide 2023

Pdf Rethinking Property Tax Incentives For Business Rethinking Property Tax Incentives For Business

Can You Deduct Mortgage Interest On A Second Home Moneytips

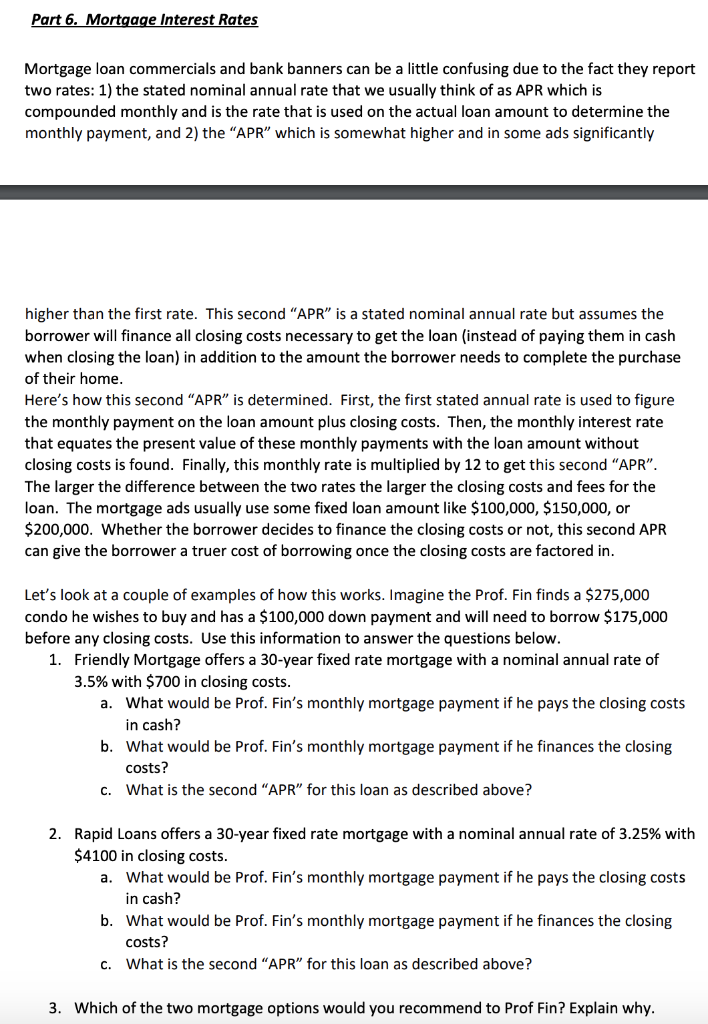

Solved Part 6 Mortgage Interest Rates Mortgage Loan Chegg Com

Deduct Mortgage Interest On Second Home

Multi Drop Bus And Internal Communication Protocol Pdf Pdf Transmission Control Protocol Specification Technical Standard